The Basic Principles Of Estate Planning Attorney

The Basic Principles Of Estate Planning Attorney

Blog Article

Our Estate Planning Attorney Statements

Table of ContentsEstate Planning Attorney for BeginnersEstate Planning Attorney Can Be Fun For Anyone5 Easy Facts About Estate Planning Attorney ExplainedIndicators on Estate Planning Attorney You Need To Know

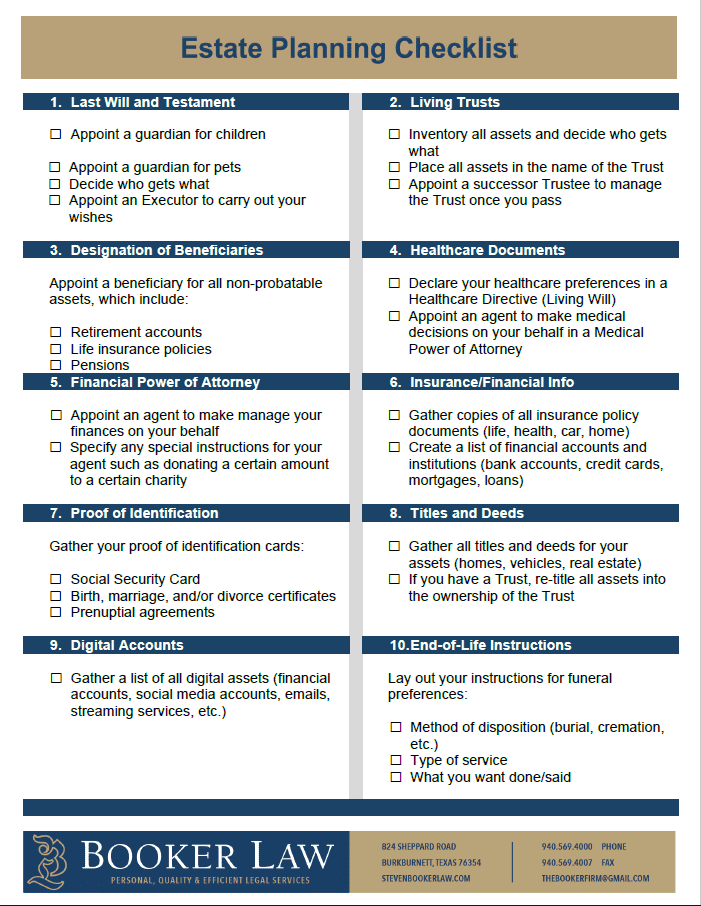

Estate planning is an activity strategy you can utilize to identify what takes place to your properties and obligations while you live and after you die. A will, on the other hand, is a legal paper that lays out just how properties are dispersed, that deals with kids and pets, and any other dreams after you pass away.

Cases that are rejected by the executor can be taken to court where a probate judge will have the final say as to whether or not the claim is valid.

Not known Facts About Estate Planning Attorney

After the stock of the estate has actually been taken, the value of properties computed, and taxes and debt repaid, the administrator will then look for permission from the court to disperse whatever is left of the estate to the beneficiaries. Any estate taxes that are pending will certainly come due within 9 months of the date of fatality.

Each individual areas their possessions in the count on and names someone various other than their partner as the beneficiary., to sustain grandchildrens' education and learning.

Not known Facts About Estate Planning Attorney

Estate planners can collaborate with the donor in order to minimize gross income as a result of those contributions or develop techniques that take full advantage of the effect of those donations. This is an additional strategy that can be used to restrict fatality taxes. It entails an individual securing the existing value, and therefore tax obligation liability, of their residential or commercial property, while connecting the worth of future growth of that click here for info resources to one more individual. This approach involves freezing the worth of a property at its value on the date of transfer. Appropriately, the quantity of potential capital gain at death is likewise iced up, allowing the estate planner to estimate their prospective tax obligation responsibility upon death and better prepare for the repayment of revenue tax obligations.

If sufficient insurance policy profits are available and the policies are correctly structured, any type of earnings tax obligation on the regarded personalities of properties following the death of an individual can be paid without resorting to the sale of assets. Proceeds from life insurance coverage that are gotten by the beneficiaries upon the fatality of the guaranteed are normally revenue tax-free.

There are particular papers you'll require as part of the estate planning procedure. Some of the most usual ones include wills, powers of attorney (POAs), guardianship designations, and living wills.

There is a misconception that estate preparation is just for high-net-worth individuals. However that's not true. Estate planning is a tool that every person can utilize. Estate preparing makes it simpler for individuals to establish their desires before and after they pass away. As opposed to what many people think, it extends past what to do with possessions and obligations.

The 8-Second Trick For Estate Planning Attorney

You must start preparing for your estate as quickly as you have any kind of quantifiable possession base. It's a recurring process: as life advances, your estate websites plan need to shift to match your scenarios, in accordance with your brand-new objectives. And maintain it. Not doing your estate planning can create undue monetary burdens to liked ones.

Estate planning is commonly taken a tool for the rich. However that isn't the instance. It can be a useful way for you to handle your possessions and obligations prior to and after you pass away. Estate preparation is additionally a great way for you to lay out plans for the care of your minor children and pets and official statement to describe your desires for your funeral service and preferred charities.

Applications need to be. Qualified applicants who pass the test will certainly be officially accredited in August. If you're qualified to sit for the examination from a previous application, you might submit the short application. According to the guidelines, no qualification shall last for a duration longer than 5 years. Locate out when your recertification application is due.

Report this page